Big Issue Frontline

Since 1991 our frontline service teams have supported over 107,000 vendors to earn more than £150M. Our Hand Up programme has connected more than 31,000 vendors to the vital resources, services and opportunities needed to turn their lives around.

In 2022, we experienced a 10% increase in vendors and a 20% increase in vendors needing urgent support. Our new unified frontline team ensures vendors find it easy to access the end-to-end support they need including sales set up and support, access to health and wellbeing services and employment opportunities.

Our unified frontline service, is funded through our Big Issue Changing Lives Community Interest Company. This social business ensures your money goes further to help more people work their way out of poverty.

By contributing to our new CIC, you are directly funding our frontline team who work with vendors to change their lives through enterprise.

Your support is vital in helping more people to work their way out of poverty, during this cost-of-living crisis.

Frontline Services

Frontline FAQs

Vendor News

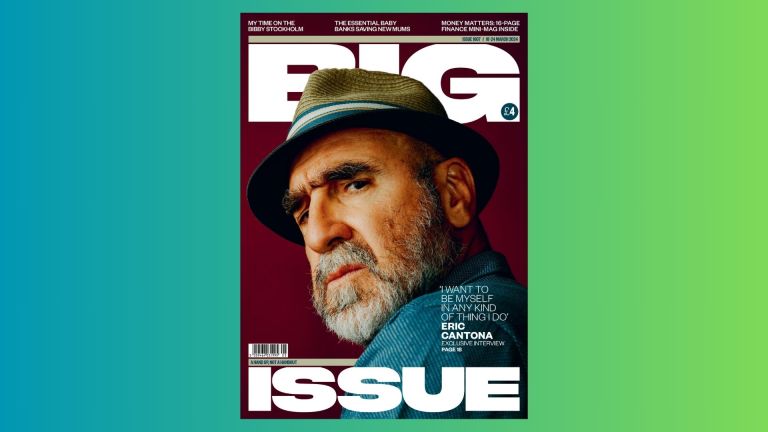

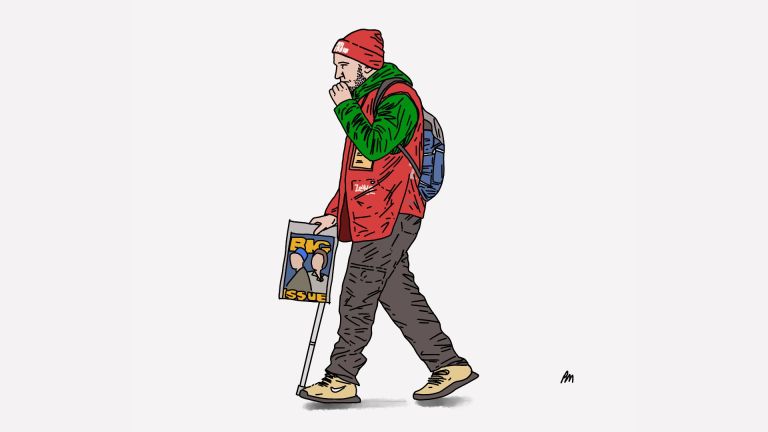

Artists pays tribute to Big Issue vendors in thought-provoking project: ‘Ordinary moments go unnoticed’

Big Issue founder John Bird celebrates vendors at House of Lords – and vows to help end destitution