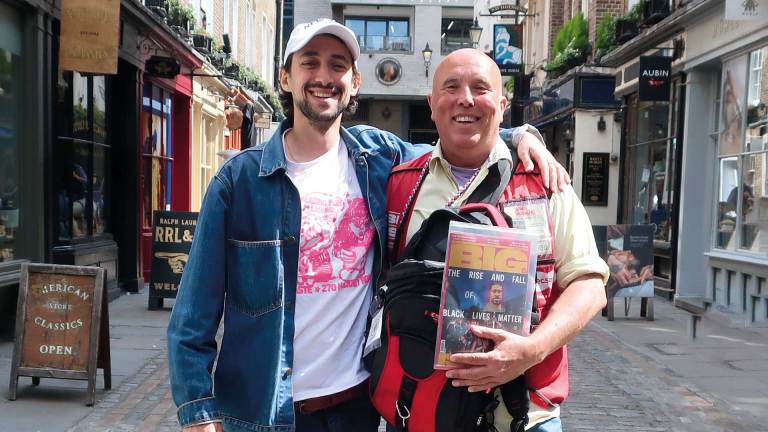

Big Issue Support Service

Enabling and supporting people to earn and work their way out of poverty

Since we launched in 1991, our Big Issue Support Service has enabled over 108,000 vendors to sell 229 million copies of the Big Issue magazine and earn more than £154 million in income.

Our regional support teams, based across the UK, work with people affected by poverty every day, in our offices and on the streets.

Our team is highly skilled. We work with individuals with complex needs and do whatever it takes to help people earn a living and build a better future for themselves. We do this through:

- Checking their ID to ensure they are over 18 and able to sell

- Locating them a pitch to sell on

- Providing them with five free copies of the Big Issue magazine to get started

- Allocating a vendor badge to ensure the public know they are legitimate sellers

- Enabling them with some sales tips and skills to start earning and engage with their customers

Five pillars of support

The Big Issue Support Services helps vendors access essential services across five key pillars. These help people get back on their feet and work towards a better future for themselves.

- Housing: Access to and maintenance of secure, affordable, and stable homes

- Health & Wellbeing: Access to adequate food, weather appropriate clothing, home energy, toiletries, and other essentials. Access to the right care and treatment for physical and mental health needs, including addiction support, registering with a GP and Dentist. And access to resources to sustain health.

- Financial & Digitial Inclusion: Supporting individuals with budgeting, saving and debt support, financial advice and benefits services. Access and capability to use the internet to reach essential services and support with setting up and using a bank account. Access to enablers for active citizenship including gaining official ID, developing language skills, and establishing social networks.

- Community & Environment – Working with local communities and community groups, to establish vendors as part of the community. Work with people affected by poverty in local communities including moving people from on street begging to vending, to enable people to earn a legitimate income and gain valuable social skills and interact with their communities.

- Learning & Employment – Unlocking skills and training, identifying employment opportunities and working with staff on a one-to-one basis to build confidence and resilience to find and sustain employment.

Would you like to support the work of the Big Issue Support Service? Every contribution supports a vendor to earn, learn and thrive.

Useful Information

Services

Our Vendors

Vendor News

A View, From a Bridge is the social media sensation where strangers reveal all on an old, red phone

Letters: Landlords should be made illegal to fix the housing market

Letters: Reform getting in will cause a lot of civil disruption