“It’s unacceptable that so many are seeing their income completely disappear on everyday essentials, like rent, water and food, which leaves them struggling to cover all their bills let alone save for emergencies like a broken fridge or oven.”

Independent Age has heard from older people who have been “forced to sit in cold homes because they cannot afford to fix their boiler”. Others have gone without items such as mattresses and fridges because they cannot afford to repair or replace them.

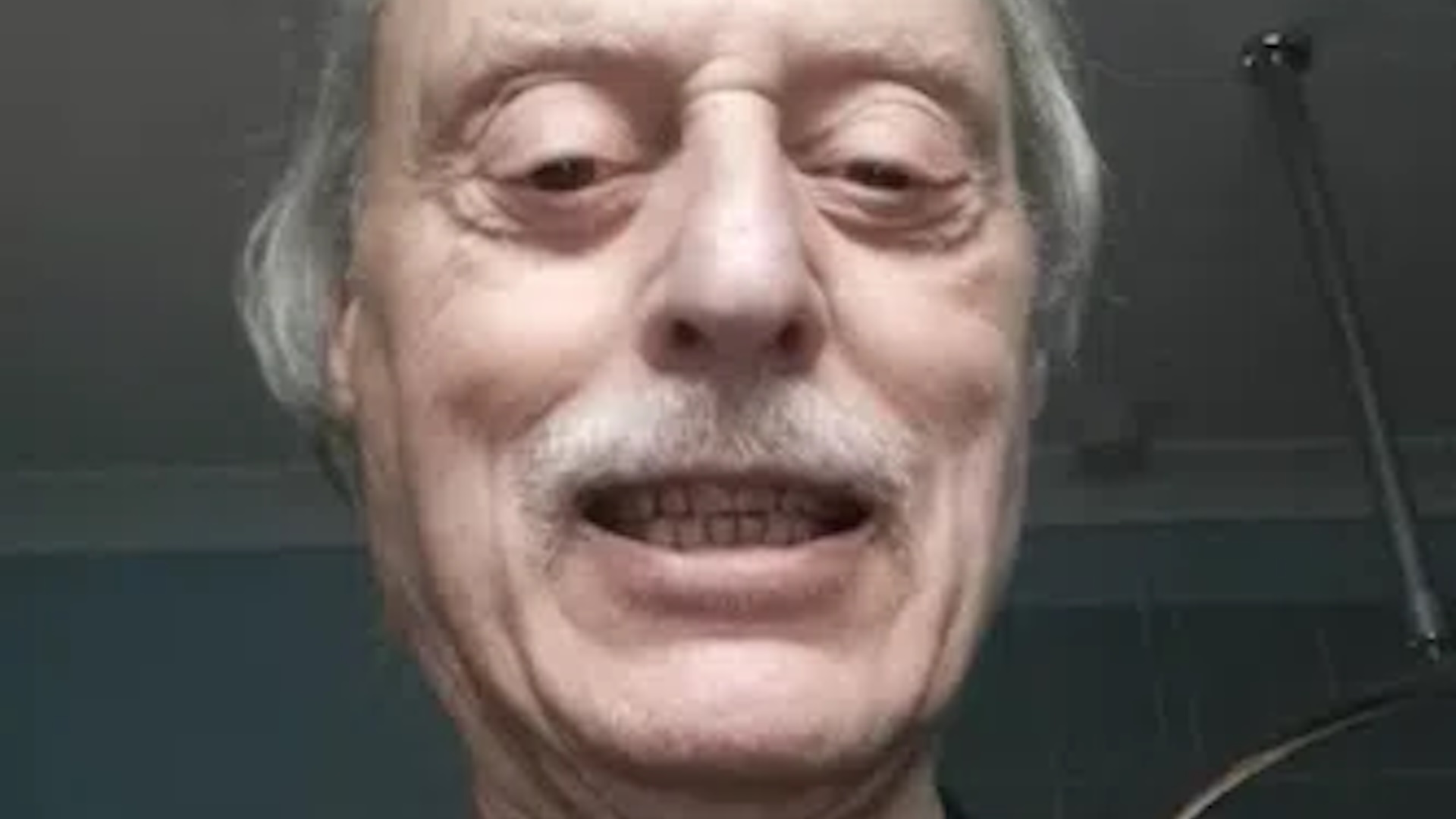

Paul says he could “probably manage” a £50 bill but would struggle with “much more beyond that”.

“I spent my burial fund to have [the roof] repaired,” he tells Big Issue. “And it still leaks. That was the last of the funds so if I do get another bill come in, I couldn’t pay for it.”

More than half (52%) of low-income pensioners would struggle to pay an unexpected bill of £250 without borrowing, Independent Age found. One in three said they would have to use a credit card to cover the cost.

Paul says he feels “angry, upset and disconcerted” that older people are struggling to afford their bills.

Advertising helps fund Big Issue’s mission to end poverty

“You’ve worked all your life and then you end up living in poverty,” he adds.

Paul says he had a long career – a decade at a timber company before he worked for a sales company in installation and then started his own installation business. Before retiring, he ran an import-export agency. But despite his years in employment, he has struggled to afford retirment.

“An intervention from the UK government is urgently needed. More must be done to protect older people with little or no savings from unexpected bills,” Elson says.

Independent Age is calling for the government to introduce policies which will protect older people from financial hardship – including support to help low-income households cover emergency costs.

The government is set to introduce a crisis and resilience fund from April 2026, which will replace the household support fund and provide immediate crisis support and long-term help to build people’s financial stability over time.

Elson said that the fund has “potential” but it “must be well-promoted and offer consistent support across the country for a broad range of emergency costs”.

Advertising helps fund Big Issue’s mission to end poverty

Independent Age also wants to see a national strategy to guarantee that every older person receives the financial support they are entitled to through the social security system.

There is a range of support already available to support pensioners. The full state pension is £230.25 every week, which is more than double the amount given to universal credit claimants and around £50 more a week than the maximum amount of personal independence payment (PIP).

There is also pension credit, an additional benefit which is given to low-income pensioners.

A government spokesperson said: “Supporting pensioners is a top priority. Our commitment to the triple lock means millions of older people are set to see their state pension rise by £1,900.

“On top of this, we have expanded the £150 warm home discount to six million households, seen water tariff support extended to 9% of all households and given an extra 57,000 pensioner households pension credit – worth on average £4,300 a year.”

Paul claims he has not been eligible for pension credit for a number of years, after the state pension increased and tipped him over the threshold. This meant he also missed out on the winter fuel payment when the government axed it for the majority of pensioners last year.

Advertising helps fund Big Issue’s mission to end poverty

After significant backlash, the government has reinstated the winter fuel payment for most older people. It will be paid automatically to all pensioners and then taken back by HMRC for any pensioner with an income more than £35,000.

Chancellor Rachel Reeves said: “Targeting winter fuel payments was a tough decision, but the right decision because of the inheritance we had been left by the previous government.

“It is also right that we continue to means-test this payment so that it is targeted and fair, rather than restoring eligibility to everyone including the wealthiest. But we have now acted to expand the eligibility of the winter fuel payment so no pensioner on a lower income will miss out.”

Despite the welcome expansion of this support, Independent Age fears that it will not be enough to support pensioners living in poverty this winter.

Ahead of the chancellor’s autumn budget, Independent Age is calling on the government establish a national water social tariff in England and Wales, and for the warm homes discount to be increased to £400 to reflect current energy bills.

Elson says: “The UK government needs to take real steps to boost the income of older people in financial hardship so that emergency costs do not mean getting into debt.

Advertising helps fund Big Issue’s mission to end poverty

“This includes introducing an all entitlement take-up strategy that simplifies the application process and ensures older people on low incomes receive all the financial support they are entitled to.

“We cannot stand by while older people in poverty are forced into debt just to keep their appliances running and their homes in good condition.”

The Department for Work and Pensions (DWP) has been contacted for comment.

Do you have a story to tell or opinions to share about this? Get in touch and tell us more.

Change a vendor’s life this Christmas.

Buy from your local Big Issue vendor every week – or support online with a vendor support kit or a subscription – and help people work their way out of poverty with dignity.

Advertising helps fund Big Issue’s mission to end poverty