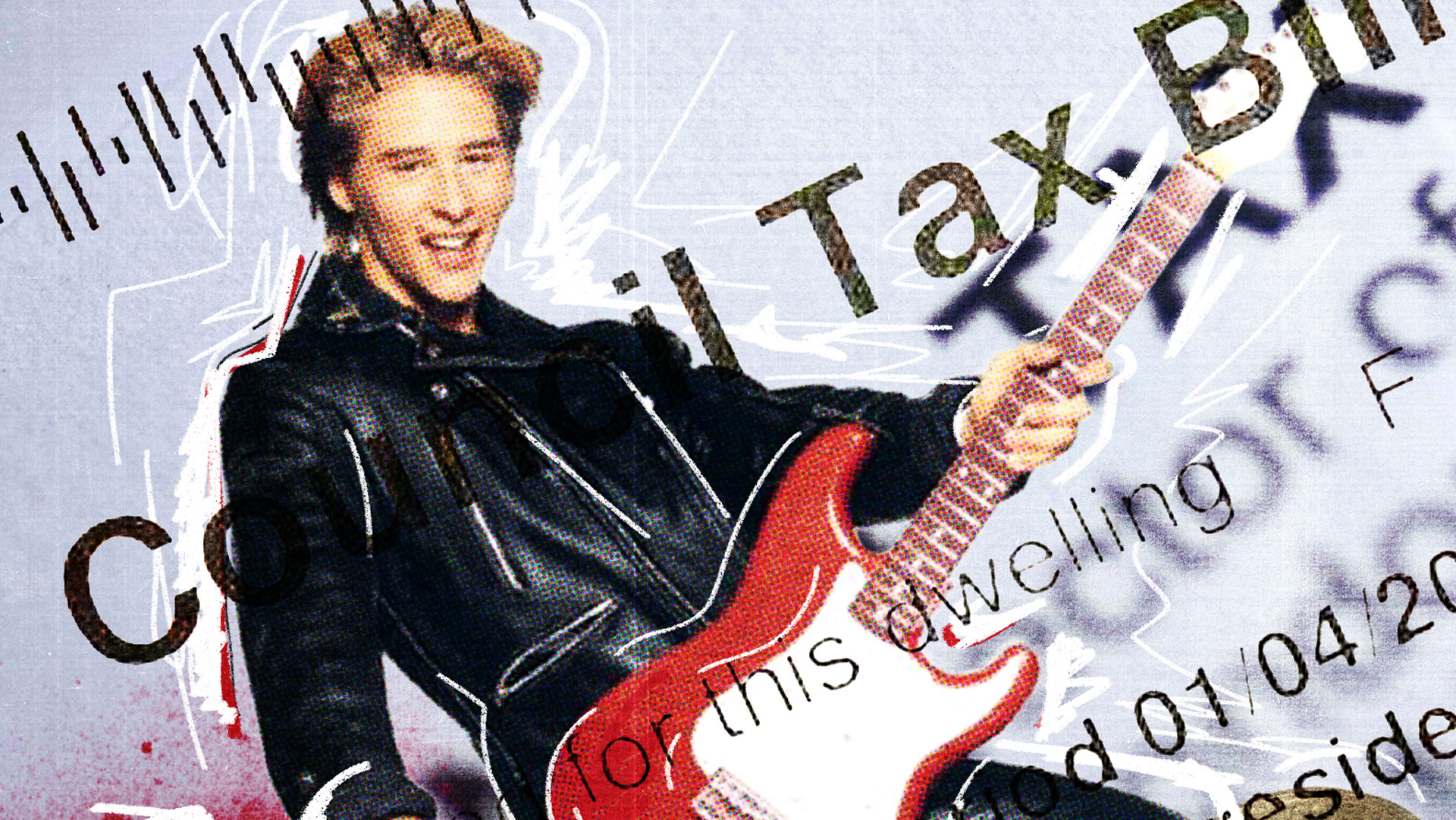

To say our current property tax system is out of date would be a major understatement. Council tax is based on property valuations from 30 years ago, undertaken when Chesney Hawkes was No. 1. Perhaps The One and Only was simply a reference to your first council tax evaluation.

Partly as a consequence of being so behind-the-times, council tax is also deeply unfair. People who live in modest homes get a worse deal than those living in the wealthiest areas, while struggling renters are hit just as hard as their, often older, counterparts who have made it on to the property ladder. Too often, council tax works for the millionaires rather than the millions – and works against the drive towards intergenerational fairness.

That’s why the Fairer Share campaign is pushing our parliamentarians to back a fairer system that works for everyone. Our analysis shows that if the government were to scrap council tax and stamp duty and bring in a simple proportional property tax, this would bring in exactly the same amount of revenue as the current arrangement. Set at a flat rate of 0.48 per cent of a property’s value, and a proportional property tax would mean lower bills for 76 per cent of households in England and average savings of £435 a year. Furthermore, 99 per cent of the households in the most deprived 10 per cent of constituencies in England would benefit from the change.

Of course, inflated prices mean the value of some homes may not always tally with the finances of those who own them. For that reason, there would be safeguards in place to protect those who live in valuable properties yet do not have a lot of disposable income. Under a proportional property tax, the so-called “asset rich, cash poor” who cannot afford to pay it would have the option to defer payments and pay instead a modest interest rate until they sell up and settle the balance.

For 30 years council tax has been writing its own obituary. But, since the pandemic hit, changing the financial outlook for millions of people, the case for abolishing council tax and bringing in a fairer property tax system in the UK has only become more compelling.

Council tax is one of the household bills on which millions are falling behind, creating debt and forcing people out of their homes

Earlier this year, Citizens Advice revealed that council tax debt was the number one debt issue they were dealing with, seeing people racking up millions in arrears as a result of Covid-19. This month, we also learned that

2.5 million people are behind on their broadband bills, with 700,000 of them falling into the red during Covid. It comes at a time when people are more reliant on broadband for work and for helping their children with school work, with UK adults spending an average of 22 hours online each week.