“That’s not enough.” There’s nothing else to say when the mortgage advisor is presented with my house-hunting budget. Skimping and saving with hopes of buying my first home, I thought my efforts would at least be rewarded with the option of an ageing shell. I have a good job and decent deposit thanks to inheritance from four relatives and half a decade of saving, but the bank won’t budge. I can’t afford anything. “It’s because you’re doing it alone.”

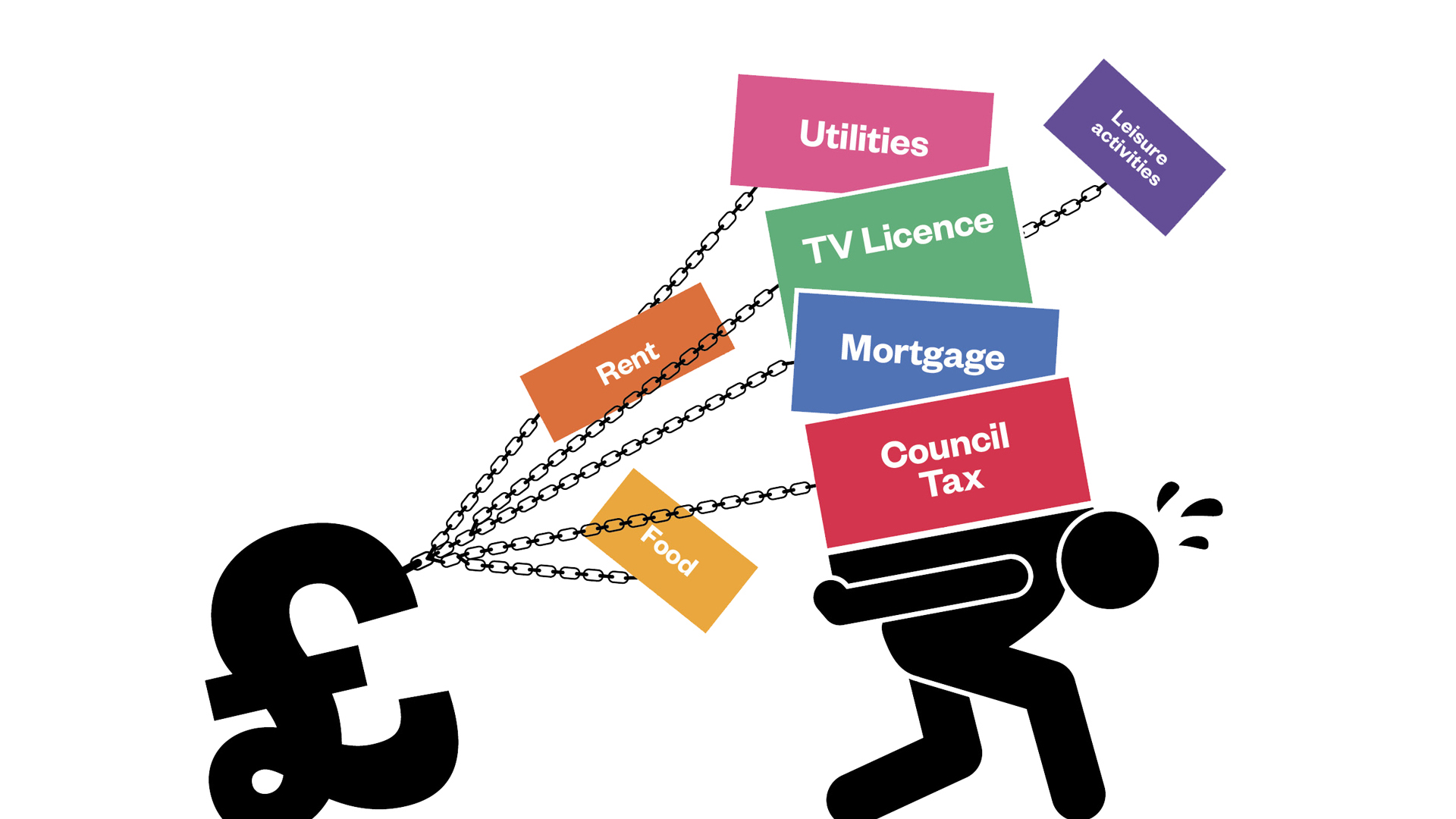

It’s a sinking feeling increasing numbers of people can relate to. You might be signing a phone contract (“It works out cheaper to sign up for our family plan”), planning a holiday (“The double room is the same price whether for one or two people”), or, like me, trying to get a mortgage. You’re constantly bombarded with reminders that not only are you single, you have to pay for it too.

Change a Big Issue vendor’s life this winter by purchasing a Winter Support Kit. You’ll receive four copies of the magazine and create a brighter future for our vendors

As both a financial expert and single person, Finn Wheatley understands this professionally and personally. “The cost of living alone adds up. For one, taxes hit single people harder than couples or families,” he says, referring to the Marriage Allowance which can reduce a couple’s taxes by up to £1,000 a year. “Living by myself, everything from rent to groceries to healthcare was my responsibility alone, without anyone to split costs with.”

It’s understandable how some costs – paying bills, mortgage or rent – are cheaper for couples who simply share the costs. But it’s also more expensive to have fun when single. Steven Kibble, a financial planner and advisor, found his “clients who live alone spend 20-30% more on non-essential shopping and leisure activities compared to partnered clients with similar incomes”. Why? Because, despite single households being the fastest-growing demographic in the world with 8.3 million single-occupancy households in the UK alone, everything is set up for couples or families.

For one example, take television. A TV licence is £159 per household, whether there’s just you or a large family at your address. It’s the same with streaming subscriptions. Single people also miss out on group deals like two-together railcards, which save travellers around £153 a year. In their Average UK Household Cost of Food 2024 report, NimbleFins found food costs more too as items are packaged with a two-to-four-person meal in mind. For a couple, weekly shops cost just over £1,900 each a year, while singles fork out around 25% more at £2,340.