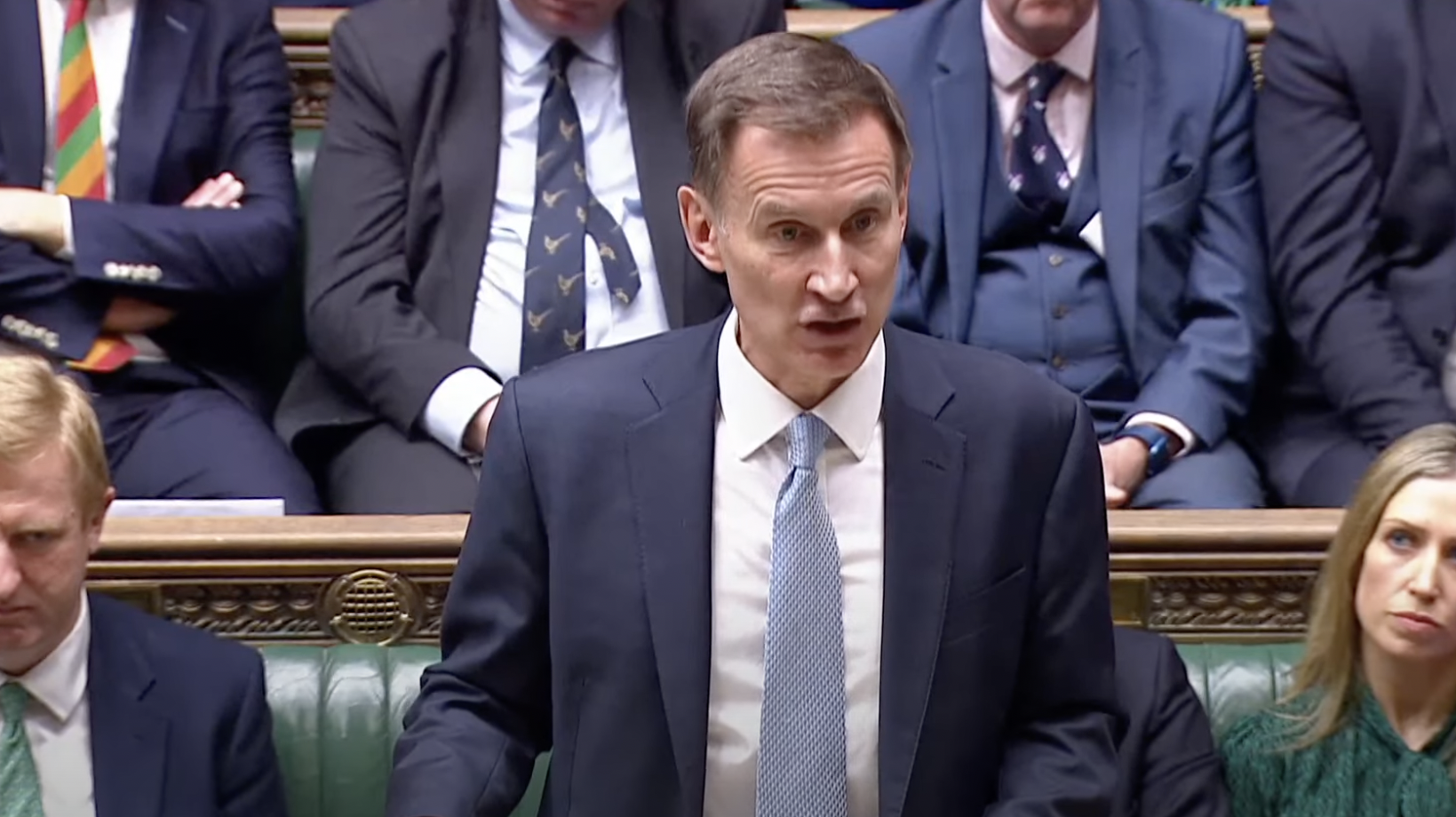

A cut to National Insurance comes into force from Saturday (6 April), hailed by chancellor Jeremy Hunt as part of “record tax cuts” which shows the government “stands behind those who work hard”.

Despite claims of a £450 boost to incomes, it offers little for low earners – with only those earning above £26,000 a year set to benefit overall from the change.

The tax, which makes you eligible to receive benefits like the state pension and jobseeker’s allowance, is being cut from 10% to 8%. National Insurance is paid by those earning over £12,570 a year.

At the same time, minimum wage has increased by almost 10% this month, but the level at which you start paying tax has stayed the same. This “fiscal drag” means many will start paying tax, or pay tax on a larger amount of their earnings. For those on lower incomes, it will mean a higher tax bill.

The ‘stealth tax’ led to Hunt being branded a “fiscal drag queen” after delivering the Spring Budget in March. As well as a freeze in the point at which employees start paying National Insurance, the income tax threshold will remain frozen at £12,570 until 2028.

In fact, for every £1 gained by the cut to National Insurance, £1.30 will be taken away thanks to the frozen threshold, the Institute for Fiscal Studies estimates.