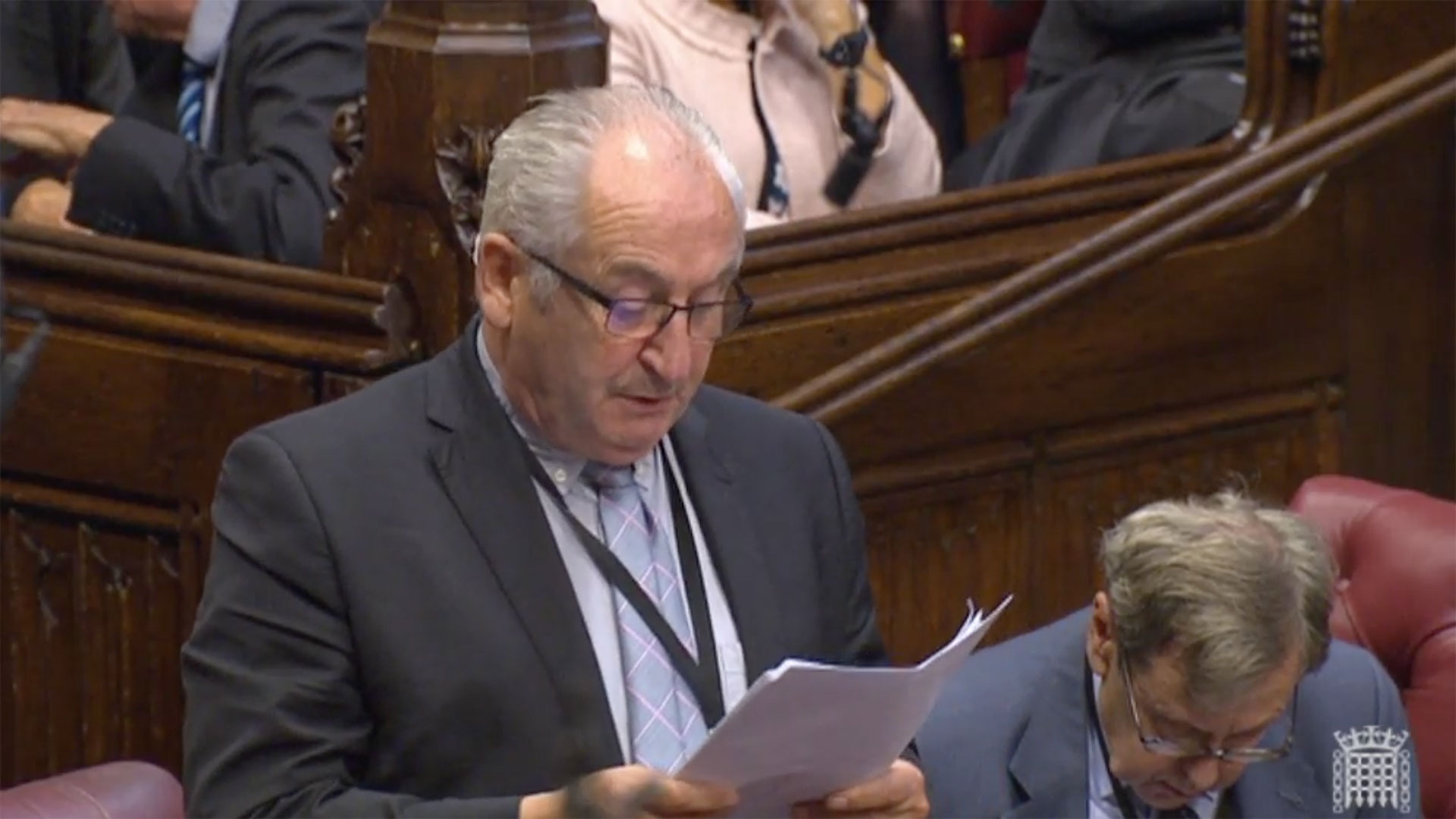

Big Issue founder John Bird has launched his own bill in the House of Lords aimed at helping millions of renters get fair access to credit.

Lord Bird – now a crossbench peer – introduced his own private member’s bill on Wednesday on creditworthiness, a bill designed to create a level playing field when it comes to the availability and affordability of credit.

At the moment the rental payments of the UK’s 11 million renters aren’t recorded or recognised in the same way mortgage payments are. It means some of the country’s least well-off pay the most to borrow, including repayment contracts for white goods, utilities and mobile phones.

We’re trying to help reliable rent-payers get the same advantages as reliable mortgage payers

“If you are a rent payer, even if you pay your rent on time for many years, it won’t necessarily get the credit file that you would if you were paying a mortgage,” Lord Bird explained.

“So we’re trying to help reliable rent-payers get the same advantages as reliable mortgage payers.”