We’re responsible in our decision-making. We turn down 27 per cent of applications because we don’t have enough information. Not being able to access credit because you can’t afford to repay it is perhaps understandable for most people. What about when you can afford payments but your credit file doesn’t show that?

We do everything we can to find the information we need to assess a loan application. We request statements to support that decision (we pay for that), we can check previous addresses (we pay for that too), and we are looking at using a second bureau to help us to see more information (we pay double for that).

We pay so much more to be able to see information about those who we seek to serve, yet our average loan is only £300 – and if the customer pays back over three months we only earn £18.80 in interest.

We are campaigning to get better credit ratings for those who most need to use credit at times

Like The Big Issue we are campaigning to get better credit ratings for those who most need to use credit at times. We support Lord Bird’s Creditworthiness Assessment Bill to widen the information that is accurate and available on your credit file that can show you are managing your day-to-day expenditure such as rent and utilities.

Inaccurate credit files

In the UK one of the main barriers to responsible lending is that most credit files are not accurate, not complete and not up to date.

We have been asking the regulators to act and help us to do what we do well and serve more lower-income families in the UK.

- We believe that high-cost credit providers should be obliged to report their data to all of the main credit bureaux – that means organisations like us only have to check one bureau.

- We think that for families that use pay-weekly credit, we should report our credit files weekly, so they are not months out of date – so we can see if customers are in a property and managing their credit within two weeks not two months.

- We think that every time we agree or decline a loan that we should be able to tell the customer the key points on their credit file that made that decision to empower our customers to address this – especially to challenge if the information is wrong.

- We think that high-cost credit providers and credit bureaux should be held responsible for the data that is used – this data is bought and sold more than any other in the UK, and yet very few are ever held responsible when that data is shown to be misleading resulting in customer detriment.

In a recent survey where we asked customers to check their credit file and tell us if it was accurate, over 60 per cent reported errors – with over 40 per cent saying they had arrears showing which was not up to date.

Many mainstream lenders like banks and building societies don’t like to lend to people on low income, or with fluctuating income or where benefits are a large part of the income. That is now a huge part of the UK population that has to turn to high-cost credit.

Until we address the issues with credit rating information for those who most need credit for essential purchases, affordable and responsible credit providers like Fair for You will keep having to spend more to assess loan applications, and still turn down families who are not asking for a handout or charity but want to be able to buy a cot or a cooker and spread the cost within their weekly budget.

That just isn’t fair.

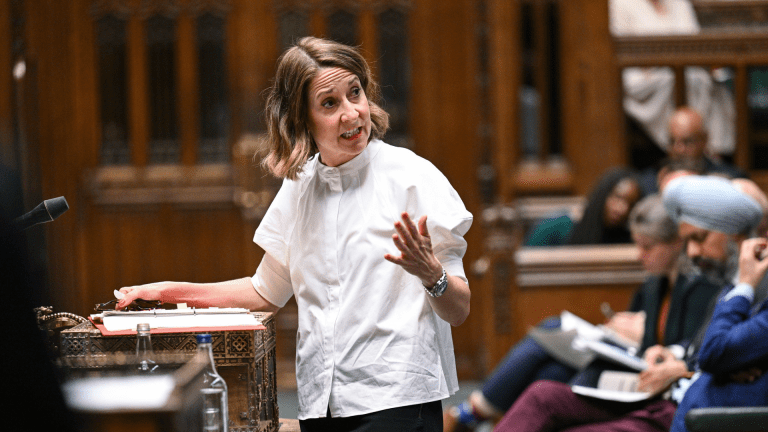

Angela Clements is the chief executive of Fair for You